I admit I am biased about pet insurance. I like it, mostly. Clients who had it were, in my experience, much more likely to approve necessary treatments. That dog with a case of happy tail who wagged it so hard and so fast he got a nasty deep infection that ended up necessitating a partial tail amputation? Insured. Hit by car? Insured. From my perspective, it allowed owners to focus on the pet’s immediate needs and get them taken care of.

I also liked it because I didn’t have to do anything to get it taken care of, other than fill out a brief form. The owners paid me upfront, and were reimbursed by their company after the fact. If the owner and the insurer had a disagreement about what should or should not be covered, it wasn’t something I had to get involved in. It was nothing like human medicine. The summer before I started veterinary school, I actually worked the front desk in an internal medicine MD practice and good lord, those staffers spent probably 33% of the day dealing with insurance issues.

Just a few years ago, I could list three pet insurance companies, tops. Now there’s almost too many to count, with good policies and bad policies and fine print a mile long and exclusions even longer, especially if you have a bulldog in which case you might as well just get a second job.

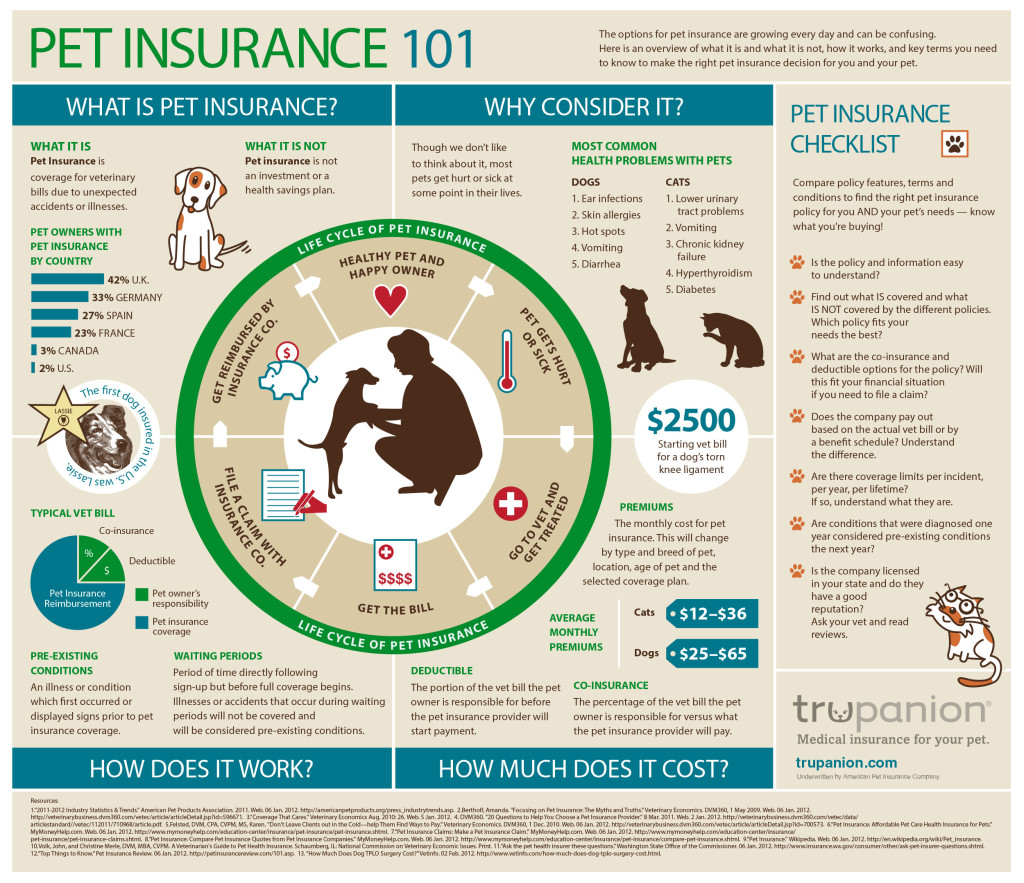

Some pay a flat percentage of your bill. Others use benefit schedules, and specify exactly what amount they will pay per procedure. Most reimburse you, but I know of at least one that is rolling out a program that will pay veterinarians directly. Some cover preventive care. Some cover accidents. Some cover breed related illnesses, and others don’t. Tooth extractions? May or may not be a pre-existing condition. WHO KNOWS.

It’s gotten so confusing, even for me, that when people ask me what I think all I can say is, “Yes, go for it, but with caution.” Caveat emptor. But even then, even knowing all there is to know and asking all there is to ask, I’m hearing more and more people tell me they just spent five hours on the phone with an insurance rep trying to figure out how a newly diagnosed endocrine condition counts as “pre-existing.”

If this sounds familiar, that’s because that’s what all of us have done with our health insurers at least once, right? It’s confusing, and getting even more so the more players that enter the field. All companies are not created equal. I think most people completely understand the need for exclusions and limits, but for goodness sake let people know when they sign up what, exactly, they are signing up for.

While lawmakers in California had hoped that pet insurance would fall under the auspice of state insurance regulators, it hasn’t happened, and people with complaints have found they were pretty much out of luck. Fortunately, a new bill that already passed the legislature and is headed for the governor’s desk should give consumers a good deal more protection.

AB 2056 will make California the first state in the nation to specifically pass regulations about the pet insurance industry, separate from its current designation as miscellaneous property and casualty. It specifies the need for clear language about co-pays, exclusions, waiting periods, and caps- all the stuff people run into issues with now.

This is good news for everyone: the excellent insurance companies out there whose reputation is being sullied by the shyster groups, veterinarians who are able to better care for pets, and most of all the clients and pets who stand to benefit from better access to care.

So let’s hear it: what’s been your experience lately? Have you been blindsided or pleased with your insurance coverage?

I’ve sure heard more about exclusions than help. Good that there is promise of clearer policies. One thing about pet insurance is those who have multiple pets find it really difficult to meet the monthly for such. Almost better to set aside $30 or $40 a month in a pet account.

I think the people who have the discipline to do that make out the best, cost-wise. Of course no one ever does save a couple people 🙂

Pet insurance is something that I have been so back and forth about. I have heard wonderful and terrible things about it. I know that we would make sure our pups got the necessary treatment regardless of our circumstances, but I wonder if having insurance would be an extra peace of mind.

The accident coverage is, to me, the biggest lifesaver. Most people never use it but if a pet gets hit by a car or has another major trauma, it’s such a relief to know it won’t cost you a mortgage payment (this has been the feedback I got from my time in emergency.)

I’ve never found a traditional policy that I’ve felt is worth the cost given all the fine print, but I have had Pet Assure for several years now and I love it! I get a 25% discount on my entire bill every time I go in and there’s no paperwork or claims forms at all. I don’t know if it’s a good deal for the vet, though. With four cats and two dogs I save a ton. I just saved $53.25 today on an annual visit for my beagle and a total of $392.89 for the plan year. The plan cost me $189 for six pets, so I made $203.89! The math works for me.

I imagine if it doesn’t work to their benefit they just wouldn’t continue to be a part of the program- maybe they make up for the discount in terms of the amount of care owners are willing to get- which is fantastic. Thanks for letting me know about this program, I didn’t even know it was out there!

I am a huge fan. We got ours through AKC when they were tiny pups, and it has been a huge money saver every single year. Most years it’s routine stuff – minor injuries, ear issues, asprirates and biopsies. But it’s also great for the big stuff, and we’ve had plenty of that with our two boxers. My boy spent three days in our regions serious pet hospital for pancreatitis – covered. He’s had three mast cell tumors removed by a board certified surgeon, one of which was problematic and let more than a dozen visits, including two to the e-vet. All were covered. My girl has serious allergies – the testing and the weekly allergy shots are covered. (Not surprisingly the prescription food is not). They’ve covered holter monitors and heart meds. My girl has lymphoma and they have covered that. They don’t cover arthritis, which is a bummer, but I’ve been more than happy. They’ve switched names several times, but they’re Pet Partners now.

I’m so glad to hear that! I want people to share the companies they like and are upfront.

Great post! I just got my Search and Rescue dog signed up on VPI including their wellness rider. They came highly recommended and so far I’ve had a good experience with them. Quick reimbursement and a lot better ‘coverage’ for the cost. Since Luna and I get into some really rough situations I feel a lot more at ease having the insurance. We recently put it to the test because of STARI from a bad bed of ticks. I wrote a short article about STARI, I should have mentioned the pet insurance!

Basically with VPI’s coverage I will at least break even with the cost of the premium and have protection for any major injuries or illnesses.

I have Trupanion. They are awesome. Yes, the deductible is per incident (so you could pay more than one in a year) but there is no limit on the amount they cover and they cover illnesses your breed is genetically prone to. I got reimbursed right away when Gretel needed to stay in the emergency room overnight and a little letter thanking me for taking such good care of her.